dependent care fsa rules 2021

The Dependent Care DepCare FSA is intended for eligible. See examples on the standard deduction page under the table item Dependent.

Hsa And Fsa Eligible Expenses For Mom Baby And Parents To Be

For the 2021 tax year there is a temporary increase to the Dependent Care FSA limit.

. 101140 204a1 inserted at end If any plan would qualify as a dependent care assistance program but for a failure to meet the requirements of this subsection then notwithstanding such failure such plan shall be treated as a dependent care assistance program in the case of employees who are not highly compensated. An eligible dependent is defined as a spouse qualifying child or qualifying relative. Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parents.

The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to. For DCAs the annual contribution limit is 2500 per year if you file your tax return as married filing separately and 5000 for joint tax returns. The dependent standard deduction for 2021 Returns is 1100 or the sum of 350 plus the dependents earned income.

For participants who had an active FSA on Dec. If your dependent is claimed on your tax return they may still be required to file an income tax return of. Paying for childcare and dependent care can be very expensive.

Temporary special rules for dependent care flexible spending. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples.

Unlike a Healthcare FSA Dependent Care Accounts DCAs offer a family contribution option which means you only need one DCA to cover your household. Dependent Care Flexible Spending Account FSA. This is a pre-tax benefit account used to pay for eligible dependent care services including in-home care long-term care and assisted livingThis type of account takes money from your earnings before taxes are deducted and deposits it in a medical savings plan which you can use to pay health care costs for your loved.

Changes to dependent care benefits for 2021. Below the calculator find important information regarding the 2021 Child and Dependent Care Credit CDCCThis credit has been greatly changed as part of the third stimulus bill or American Rescue Plan Act. In order to qualify for the mid-year change the normal rules must apply.

Here it is the most-comprehensive eligibility list available on the web. But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021. As a result of the Consolidated Appropriations Act of 2021 and because the State Insurance Committee voted to adopt some of the provisions that the IRS has permitted plan sponsors to choose whether to adopt changes to flexible benefits are temporarily in effectClick here for more information.

The ARP permits employers to increase the maximum amount that can be excluded from an employees income through a dependent care assistance program. Dependent Care Tax Credit. Most FSA administrators have this process down to a science and have made even the most-complicated FSA claims submissions an easy process thanks to.

Get a free demo. The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundableup to 4000 for one qualifying person and 8000 for two or more qualifying persons only for the tax year 2021 This means an eligible taxpayer can receive this credit even if they owe no federal income tax. Important 2022 medical FSA and L-FSA information.

The maximum carryover amount. 2022 contribution limits and rules Health FSA. Ad Fillable Dependent Care Intranet More Fillable Forms Register and Subscribe Now.

Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in.

Easy implementation and comprehensive employee education available 247. You and your spouse are allowed to have. Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

You may contribute a minimum of 180 to a maximum of 2750 annually to your Health FSA. Elevate your health benefits. For 2021 the maximum amount is increased to 10500 previously 5000.

Parents might want to learn about Dependent Care FSA rules when one spouse is not working or when expenses fall into an eligibility gray area. Dependent Standard Deduction. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

Ad Custom benefits solutions for your business needs. The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan yearTo qualify for this relief you must have been enrolled on or before January 31 2020 and you must have unused amounts from the 2020 plan. If both you and your spouse are UC employees you may each contribute up to 2750.

You may be able to have your FSA admin send the check directly to your health care provider for you. Now the credit goes up to 8000 for one eligible dependent and up. If you had to pay someone.

Dependent Care FSA DCFSA. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. But Congress changed the rules for 2020 and 2021 during the Covid-19 pandemic because many households werent using up their FSA.

September 17 2021 September 16 2021 by Kevin Haney. Fortunately there is a tax credit to help defray the costs.

Fsa Mistakes To Avoid Spouse Dependent Rules American Fidelity

Glossary Of Terms Section 125 Plans 99 Core Documentscore Documents

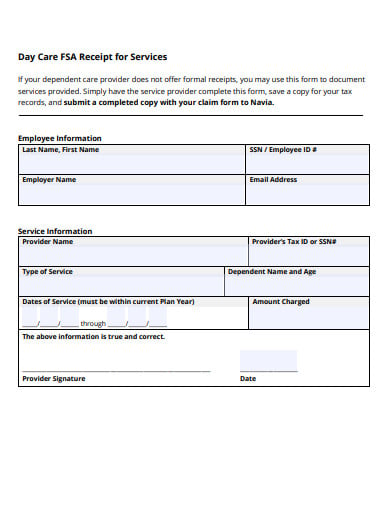

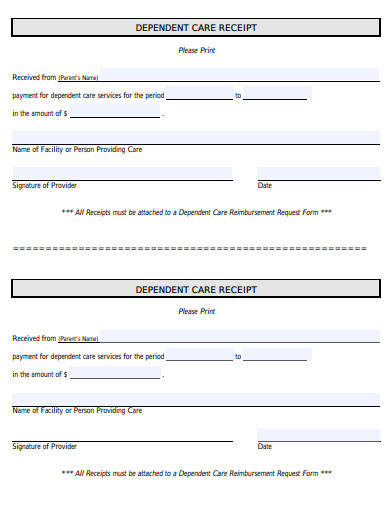

Explore Our Sample Of Child Care Expense Receipt Template Receipt Template Child Care Services Receipt

Dependent Care Flexible Spending Account Fsa Eligibility Expeneses More

Arpa Preliminary Guidance Dependent Care And Other Highlights From The Arpa New Arpa Cobra Subsidy Peters Milam Insurance Services

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

6 Nanny Receipt Templates In Pdf Free Premium Templates

Arpa Preliminary Guidance Dependent Care And Other Highlights From The Arpa New Arpa Cobra Subsidy Peters Milam Insurance Services

Fsa Mistakes To Avoid Spouse Dependent Rules American Fidelity

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Save On Child Care Costs For 2021 Dependent Care Fsa Vs Dependent Care Tax Credit

Dependent Care Flexible Spending Account Fsa Eligibility Expeneses More

Cheat Sheet To Claiming Child Care Expenses Kiddie Academy

Save On Child Care Costs For 2021 Dependent Care Fsa Vs Dependent Care Tax Credit

Irs Releases Guidance On Taxation Of Dependent Care Fsa Funds Provided Pursuant The Special Covid Relief Sequoia